Some background

Traversing Greece, Albania and the Adriatic Sea before making a landfall on Italy’s southern shores, the Trans Adriatic Pipeline (TAP) is planned to be the western section of the Southern Gas Corridor. A 3500km chain of pipelines starting in Azerbaijan’s Shah Deniz II offshore gas field, this grandiose project is designed to annually pump at least 10 billion cubic meters of gas to Europe starting 2020, in addition to 6 billion cubic meters to Turkey as early as next year.

For over 2 years now, the European Investment Bank (EIB) has been considering lending its support to TAP in the form of a €2 billion loan – the biggest single public loan in the bank’s history.

“Now that the projects have successfully reached the capital intensive construction phase, their promoters need to urgently secure adequate funding”

Maros Sefcovic to EIB President Hoyer, 13 July 2017

12 December: a crunch moment

The most recent EIB board of directors meeting coincidently took place on the same day as Emmanuel Macron hosted the #OnePlanetSummit in Paris, where political and economic leaders were gathered to discuss the role of finance in tackling the climate crisis. Activists and campaigners were able to draw enough public scrutiny of the vote to make it impossible for the EIB to make a decision to support what is Europe’s biggest new fossil fuel project.

So how do we #DefundTAP?

With the decision postponed now until the next board meeting on Feb 6th, and communities in Italy bravely resisting this pipeline in the face of fascist-era laws, now feels like an appropriate time to give some thought to other targets that we might organise around to further increase the pressure on this dangerous pipeline.

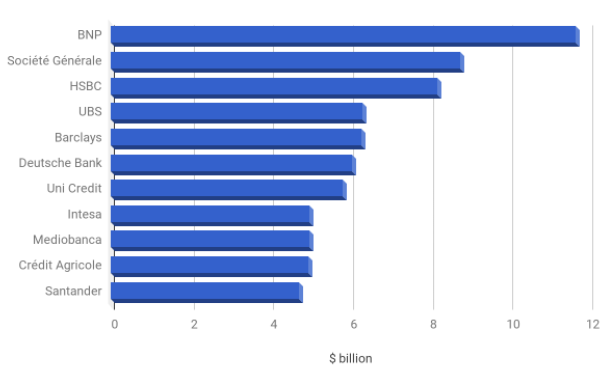

Over the last 5 years, the 11 European banks below have collectively provided over $70 billion in loans and underwriting to the 5 companies that make up the Trans Adriatic Pipeline Company, and are very likely to be approached for crucial project finance for TAP.

Two of these banks have ongoing, direct involvement in the TAP project and therefore stand out above the rest: the French bank, Société Générale has been providing financial advice to the company and its chairman, Lorenzo Bini Smaghi, is also chairman of SNAM’s board, the Italian grid operator that holds a 20% stake in the TAP company. The Italian bank, Intesa, has been providing accounts through which claimants of compensation from TAP in Albania have been forced to use.

Here’s a full list of banks and details of finance provided to the companies behind TAP (each company involved with TAP is on a different tab).

We don’t know when and how these banks might be approached for support. But with the public banks being forced to delay their support, it’s reasonable to expect that it might happen soon. By organising now, aiming to secure commitments from these banks to not fund new fossil fuels like TAP, we can put another hurdle in front of the project.

There are a number of ways in which we can actively put pressure on these banks and make it clear that TAP would be a toxic investment.

To find out how and for more information about the resistance to TAP on the ground in Italy, visit defundTAP.org