#DefundTAP

Pick a target

call on BANKS near you to #DEFUNDTAP

Stories of resistanceCall to actionPick a targetHost an action

With most of the big banks very willing to talk about all they are doing for the climate, collectively they’re still funnelling hundreds of billions of €’s every year into new fossil fuel projects. Banks must commit to stop funding new fossil fuels, now.

We’re demanding banks put an immediate freeze on:

- any new fossil fuel project finance

- organising or underwriting of bonds and shares for companies aiming to build and operate fossil fuel infrastructure projects

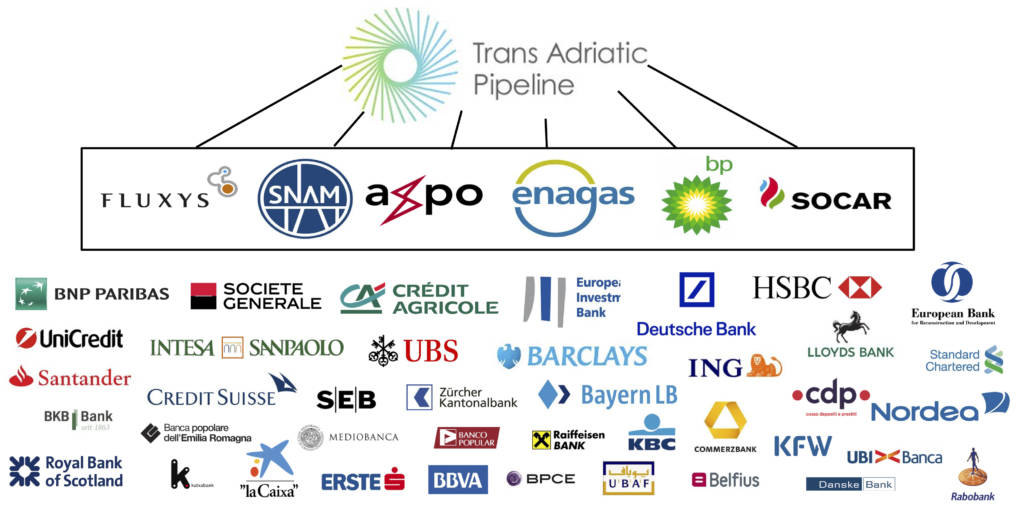

Over the last 5 years the banks below have provided finance of over €80bn to the six companies that make up TAP. While the public banks EIB and EBRD are considering multi billion Euro loans to the TAP company, private banks are eagerly waiting to join the project should the public banks give it the green light.

We can and must disrupt the flows of finance to the biggest new fossil fuel projects in Europe and beyond. Use the bank letter template below and plan an action with friends at your local bank branch or office and demand they stop funding fossil fuel projects and companies like TAP.

Top targets (PUBLIC BANKS)

Right now the European Investment Bank (@EIB) is currently considering a $2bn loan to TAP, and is the main target for us to put pressure on. You can find a list of all their office locations here.

The European Bank for Reconstruction and Development (@EBRD) is also weighing up funding for TAP — and as they admit in this video, they haven’t decided yet.

Top targets (PRIVATE BANKS)

Find out more about the private banks that will most likely fund TAP and why:

Other European banks

While the above banks are in our opinion most likely to finance TAP, it’s highly likely that any of Europe’s big banks – banks already financing new fossil fuels projects across the globe with hundreds of billions of euros – could be approached by the TAP company for support.

Below is the list of banks noted in Banking on Climate Change, a report released earlier this year detailing the finance being provided to some of the biggest new fossil fuel projects across the globe.

| Bank | 2014 | 2015 | 2016 | Total |

| HSBC | $5.338 B | $5.766 B | $2.088 B | $13.192 B |

| BARCLAYS | $4.346 B | $3.801 B | $4.381 B | $12.528 B |

| DEUTSCHE BANK | $3.282 B | $5.655 B | $2.620 B | $11.556 B |

| BNP PARIBAS | $3.743 B | $2.158 B | $1.939 B | $7.840 B |

| CREDIT SUISSE | $2.301 B | $2.584 B | $1.842 B | $6.727 B |

| SOCIÉTÉ GÉNÉRALE | $1.449 B | $3.241 B | $1.363 B | $6.053 B |

| SANTANDER | $547 M | $956 M | $2.237 B | $3.740 B |

| CRÉDIT AGRICOLE | $1.022 B | $1.335 B | $1.352 B | $3.709 B |

| UBS | $1.577 B | $1.261 B | $862 M | $3.699 B |

| ROYAL BANK OF SCOTLAND | $2.265 B | $929 M | $122 M | $3.316 B |

| ING | $844 M | $1.488 B | $963 M | $3.295 B |

OIL, GAS & ENERGY COMPANIES

Europe’s dash for gas is being driven by a small handful of largely public institutions and in collaboration with the big oil and gas transnationals such as BP, Shell, SOCAR, Gazprom and Exxon.

While the European Commission justifies it’s planned tripling of gas infrastructure across the region on energy security and diversity of supply, the truth of the matter seems much more closely connected to a small number of special interest groups looking to profit from the creation of a new market in gas.

Some not so well known companies to keep an eye on include:

Axpo – Is a Swiss based company, owned by the cantons (municipalities) in the North East of Switzerland. It holds a 5% stake in the TAP pipeline.

Fluxy’s – Is a Belgium based group, who’s stated mission is to create a new market for gas in Europe. Maximising liquidity is what they’re about – that means how to covert capital to money as quickly as possible. It holds a 19% stake in the TAP pipeline.

Snam – owns and operates the Italian gas network and holds a 20% stake in TAP.

These companies appear in project after project, be that the mega pipelines or new LNG (Liquified Natural Gas) terminals or harbours. While they don’t do the extraction (thats for the transnational mentioned above), they’re building the infrastructure and trading structures to maximise profit from fossil fuel combustion once it’s been dug up.